Why does the number of LPWAN base stations count?

Short answer, it counts a lot. Whilst the CAPEX and BoM might be relatively insignificant for gateway hardware, deployment and maintenance of a base station is a whole new thing altogether. So let’s look at the logistics of deploying a network with multiple base stations and get some perspective on this.

Why do the operators with a higher number of base stations in the LPWAN space currently lead the market? Will operators with more base stations win the LPWAN race? These are the questions we’re going to grapple with in this article.

If you travel on business then you’re happy access the internet with your smartphone. You need it to read your emails and to stay in contact with your family. And any other things you do with it – let’s not get into that here.

In my smartphone I have two different SIM cards. The SIM card for business is on operator A and my private SIM card is on operator B. A and B are the local market leaders.

On my private SIM card I could use operator C. C is not too bad but the coverage is worse, far worse in my case. A and B are better because they operate far more base stations. You can compare this with your own experiences with your smartphone.

What we have learned form our smartphone experience we can apply to the LPWAN space too. The number of gateways counts.

The link budget for Sigfox, LoRaWAN and NB-IoT is between 151 dB and 156 dB. The higher the link budget the longer the range but a 3 dB greater link budget will not increase the range much. To cover a city in terms of range it is the number of base stations that will count. No base station = no phone call. No LPWAN base station = no message transmit.

Now let’s look at LPWAN base station density…

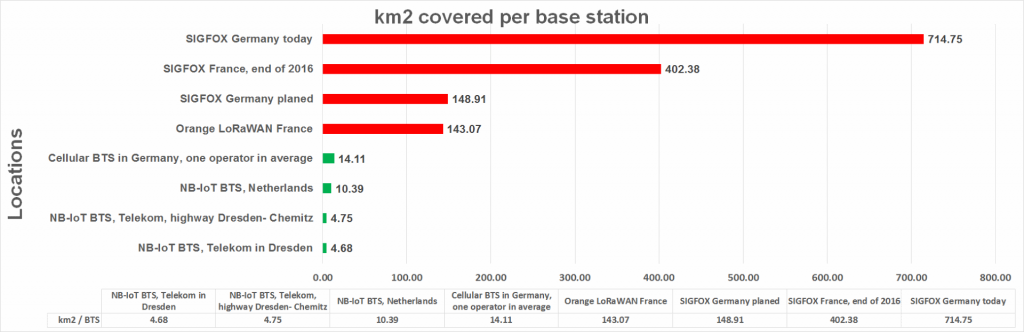

The graphic shows the base station density for several public LPWAN technologies (NB-IoT, LoRaWAN, SIGFOX) in some European countries.

For this analysis we are focusing on Europe and regions where the technologies originated. France is home to the origin of Sigfox, LoRa and Actility. In France two pubic LoRaWANs operate in parallel.

NB-IoT has its roots in Europe too. Neul in UK – the original architects of Weightless technology that is now an integral part of NB-IoT architecture – is European. Ericsson in Sweden and Nokia in Finland are significant contributors to a global LPWAN story on NB-IoT.

Weightless is not mentioned in this article because they do not run public networks for now. Furthermore, we do not talk about private LPWAN on LoRaWAN, LoRa on other protocols or further LPWAN technologies. This time we’re only writing about LPWAN technologies available in Europe.

Germany has no public LoRaWAN. But it does have two LPWAN on NB-IoT and SIGFOX

Today we make a hot spot on SIGFOX coverage maps in two different European countries, the UK and Germany. The coverage map on the SIGFOX website is a simulated coverage map for outdoor only. For indoor at the window they suggest that the link budget should be reduced by between 20 dB and 35 dB. What? That is massive. To calculate the implication just apply the Okumura Hata radio propagation model.

We went to the SIGFOX website to check the UK outdoor network coverage in comparison to the local cellular networks. When German cellular operators talk about coverage, they mean indoor coverage; they enable phone calls to be made indoors. None of us wants to go outside to make calls.

In Hamburg, Germany, we have an area of 755 km2 with 1,544 mobile base stations. That is more cellular base stations than SIGFOX has in UK, Ireland and Italy altogether.

With large umbrella cells of 6,000 square kilometres in Sunderland, a region of the UK, it is impossible to achieve an indoor coverage. Wales and Scotland, still a part of the United Kingdom have poor coverage. Read about the story of Sigfox umbrella cells here:

https://www.linkedin.com/pulse/sigfox-uk-coverage-reality-harald-naumann/

Conclusion

Sigfox is completely underdeveloped in the UK and Germany. Even in the home country of France the base station density is low.

Any country with a company that has contracted with Sigfox as a partner to provide network services is counted as a de facto national network.

Officially there is no roaming contract. Unofficial worldwide roaming is difficult because Sigfox has four different regions split by radio regulations in frequency bands, Tx power level and speed. A Sigfox device made in Europe is not able to register in the US because Sigfox has no connected messaging and will transmit and hope to be close a gateway.

An European Sigfox device powered on in the US will transmit in a frequency range used for GSM, UMTS and LTE. Again, at a Sigfox base station there was no reference signal to detect the region in 2016. A new feature is promising that, but even on request we got no SIGFOX module with this new software stack available and valid radio regulation approval. Moreover, a multi region radio is inverse to the message of low module price.

Europe networks are run by several independent companies. In the unlicensed band there are no regulations to oblige a particular operator to cover a specified region in a given time. There are no regulations to make the locations of base station public in a similar way that we do for cellular base stations in Europe. Moreover, we have one Sigfox network operator per country only. This makes national roaming impossible.

With LoRaWAN we have the same situation. LoRaWAN offers no beacon signal to detect the region. Moreover, the parameters of the LoRa physical layer are dissimilar; roaming is physical impossible. In France, two public LoRaWANs run in parallel but national roaming is impossible. Roaming between networks was not a part of the specification of the LoRaWAN stack. To add roaming you need some servers in the background to transfer the number of messages sent and received. The billing of Orange in France and KPN in the Netherlands is total different. Even with an option on roaming the billing of network, access on roaming will be difficult. Nevertheless, roaming between private LoRaWAN and public LoRaWAN would be a nice feature to save subscription costs.

Digimondo promised us a nationwide German LoRaWAN. They retracted their promise. Another German company is talking about doing the same but doesn’t have public tariffs yet. In January 2018 Germany still has no nationwide public LoRaWAN.

The LoRaWAN in Switzerland covers a part of the region only. The GSM coverage is much bigger and Swisscom will launch NB-IoT and Cat-M in parallel with LoRaWAN.

On NB-IoT everything is more transparent. Our German radio agency, Bundesnetzargentur, pressures the cellular companies to make their base stations public in one public database.

Go to www.akorIoT.com. You can get a cell scanner for less than €150. Drive around for a few days and you’ll have comprehensive maps of base station coverage.

In the case of Dresden, a German city, and the highway between Dresden and Chemnitz, we already captured data. The average size per cell in Dresden is 4.7 square kilometers. On 24.01.2018 Deutsche Telekom announced 600 German cities covered and told full coverage for end of 2018.

The data we tracked was generated with a high performance scanner and included the directions of the three sectors of each NB-IoT base stations. Telekom started with the roll out in Dresden not just for fun. They rolled out in regions with Huawei base stations first. The new Huawei base station only needs a software update.

But NB-IoT is a network in a network. The new traffic generated by NB-IoT will be stored on quite different servers. Telekom Germany and Austria promised full coverage by the end of 2018 on unbelievable low prices for the subsribtion.

According to Deutsche Telekom in Germany they have ordered 4000 Nokia base stations to replace their GSM base stations. These base stations will advance users on GPRS and EDGE to LTE.

You can be sure that these base stations will support NB-IoT as well. With NB-IoT available in 600 cities and 4000 base stations deployed by Nokia Telekom in Germany will run more NB-IoT gateways in Germany than Sigfox in France, Germany and the Netherlands altogether.

Remember that T-Mobile, a subsidiary of Telekom, already runs 4000 NB-IoT base stations in the Netherlands. The same number is possible in Austria. Estimation: 4,000 Nokia base stations in Germany + 25 BTS x 600 cities = 15,000 BTS in Germany + 4,000 in NL + 4,000 in Austria = 23,000 NB-IoT BTS on an area 25% smaller of France but fourteen times more BTS density. Inside of the Telekom group we will get roaming soon. Moreover, we will get national roaming between Telekom and Vodafone.

Base station density counts. If you use the Hata Radio Propagation for 900 MHz at 151dB to 156dB link budget then the delta in the coverage is insignificant. Read more here:

http://www.gsm-modem.de/M2M/iot-university/lpwan-coverage-range/

For indoor coverage you will need more base stations.

I hope that these few lines will motivate you to think about which LPWAN will best fit your application. If you still cannot reach conclusion based on this information and need some advice or consulting then do not hesitate to drop an email to harald.naumann (at) lte.modem.com I am working on my new IoT / M2M Cookbook related to LPWAN and I can offer you all the above mentioned LPWAN technologies. Thank you in advance for your comments at the blog or ping me an email.

References:

SIGFOX number of gateways in France:

SIGFOX presentation , Dec 2016

SIGFOX number of gateways in Germany:

SIGFOX live presentation during LPWAN congress in Frankfurt Germany.

SIGFOX coverage maps:

https://www.sigfox.com/en/coverage

Cellular BTS at Bundesnetzargentur:

http://emf2.bundesnetzagentur.de/karte/default.aspx

LPWAN coverage range on radio propagation – NB-IoT, Weightless, LoRaWAN & SIGFOX

http://www.gsm-modem.de/M2M/iot-university/lpwan-coverage-range/

600 cities in Germany with NB-IoT coverage

https://www.telekom.com/en/media/media-information/archive/telekom-leads-narrowband-iot-deployment-across-europe-512414

4471 base stations in the Netherlands

http://www.gsm-modem.de/M2M/m2m-news/nb-iot-coverage-in-nl-4471-bts-in-band-8-captain-n-b-episode-5/